Become a Fashion Consultant

Choose fulfillmentJoin over 1,300 Fashion Consultants in France and around the world!

Elora is a great human and entrepreneurial adventure. A way to take action in fashion!

At Elora, we believe in fashion that empowers, builds confidence, and allows everyone to choose their own path and fulfill themselves.

BECOME A FASHION CONSULTANT

Why Elora?

Our success is built on strong foundations, rooted in our values of quality, sustainability, and inclusivity.

Inspiring and sustainable collections

Our designers create unique collections every season, focusing on quality materials made to last. We stand against fast fashion with timeless, versatile pieces.

Inclusive fashion

All body shapes and sizes are celebrated. We design clothing that enhances every woman and boosts her self-confidence.

Personalized support

As a Fashion Consultant, you are at the heart of this special relationship. You offer expert advice, helping each client build a wardrobe that truly reflects her.

A fulfilling community

Join a dynamic and caring team, where support and sharing are at the heart of everything. You are free, fulfilled, and guided every step of the way.

The Elora Shopping Experience

We are reinventing shopping to make it a special moment of togetherness and discovery.

3 unique benefits

Create connections

Encourage meetings within a caring community where sharing is essential.

Offer personalized advice

Your clients get to feel the fabrics, try on the cuts, and benefit from your expert advice.

Experience a unique moment

Each session is an invitation to discover, in a relaxed and welcoming atmosphere.

Become a Fashion Consultant!

A unique opportunity to thrive, surpass yourself, and build a meaningful career.

Start your business with complete peace of mind

No initial investment

No diploma required

Tools and support provided

Master your time

Set your own pace

Choose your schedule

Balance your professional and personal life

Develop your skills

Ongoing training

Personalized support

Growth opportunities

Decide with complete independence

Choose where, when, and with whom

Create an activity that reflects you

Be the leading woman in your own success

Enjoy attractive compensation

Attractive commissions on your sales

Bonuses and rewards based on your performance

Evolving income potential

Being a Fashion Consultant at Elora is much more than just a job:

it's choosing freedom and becoming the driving force behind your own success.

Frequently Asked Questions

How is Elora different from other home shopping brands?

Joining Elora isn’t just about selling clothes: it’s about sharing style, confidence, and friendly moments. With more than 1,300 Fashion Consultants (also called fashion advisors) in France, Switzerland, Belgium, Luxembourg, Ireland, the UK, Germany, and the Netherlands, you become part of a dynamic community, supported by a renowned brand committed to responsible fashion.

What profile do you need to become an Elora Fashion Consultant?

No diploma or experience required. What really matters is your motivation, your

people skills, and your desire to move forward at your own pace. And let’s be honest:

working in the world of fashion is definitely more enjoyable

than many other jobs.

What if I have no experience?

No worries: you’re supported from the very beginning. A mentor guides you

through your first presentations, and you benefit from tailored training

(sales, digital, style advice, etc.) to help you progress step by step.

Can I really work at my own pace?

Yes. As a Fashion Consultant, you are free to choose: a few hours a week or a full-time activity. You decide your schedule, your holidays, and your

income.

What is the legal status required to practice?

You work as a VDI (Independent Home Sales Consultant). The VDI status is an official status

that combines freedom and protection: social security contributions, basic retirement,

the possibility to combine with another job or unemployment benefits.

Do I need to invest to get started?

No. Elora provides you with a complete collection of clothing from your very first home shopping session. You start with no upfront payment.

How will I be supported when I get started?

You start with a complete collection of clothing to present. You are never

alone: a mentor is by your side, you have access to regular training

and modern digital tools to help you get started with confidence.

What training courses are offered?

We provide you with an internal platform inspired by Netflix, featuring practical videos on sales, digital tools, style advice, and business management. In addition, online and in-person sessions allow you to learn and connect with other Fashion Consultants.

How am I compensated?

Your commission ranges from 20% to 30% of your sales, depending on your results. Here are a few examples to give you an idea:

- With 2 to 3 sessions per month, you can earn an additional income of €250 to €400.

- With 6 sessions per month, you reach around €800.

- By developing a regular activity (12 sessions per month), you can earn up to €1,800 per month.

These amounts are given as an indication, excluding challenges, bonuses, and benefits. Each session is above all a friendly moment: you share the collection, connect with your clients, and grow your business in an enjoyable way.

How can I grow my client base?

Your first clients? Often your friends, your family, your acquaintances... whom

you'll invite to private fashion presentations. It's the perfect way to gently try out the activity and build your confidence. Then, it's up to you to grow your network and reputation. Elora provides you with smart, easy-to-use tools to help you develop your client base step by step.

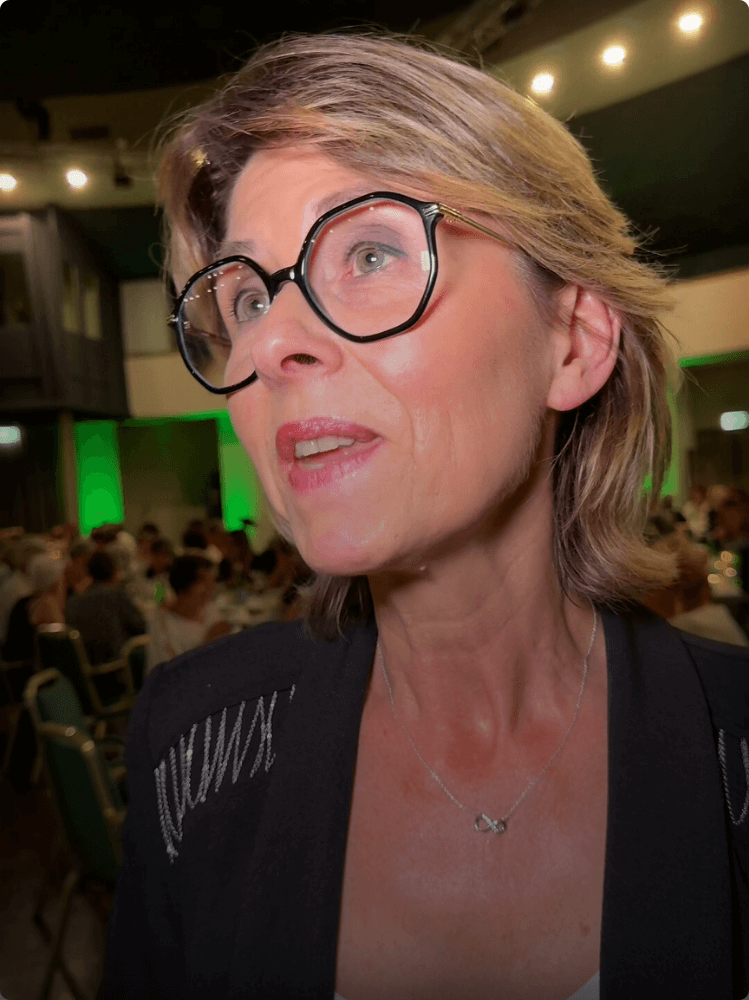

Discover the exceptional atmosphere of Elora galas

Each season, our Fashion Consultants come together for unique gatherings, blending elegance, fashion, and celebration. These signature events embody the Elora DNA: sharing powerful emotions, honoring success, and experiencing unforgettable moments, together.

The latest in home shopping

How to sell clothes at home?

If your choice is to become an Independent Home Sales Consultant (VDI) and thrive in the ready-to-wear sector, then you are about to discover a world of exciting possibilities!

How can you make up for a loss of income?

Discover how to make up for a loss of income by becoming an Independent Home Sales Consultant. Tips and advice to help you bounce back financially.

How to become a home-based sales consultant?

Discover the key steps to becoming a home-based Fashion Consultant and thriving in this field, boosting your income and finding fulfillment.